FTA? More like WTF. Flexible Trading Arrangements explained.

Stay limber, gangsters.

One of our very first posts explained how a <5MW (Unscheduled) battery can access the wholesale electricity market. The three main ways to do it, as explained in that post, are:

Via a Retailer

Via a Small Resource Aggregator (SRA)

Via a Demand Response Service Provider in the wholesale demand response mechanism (WDRM)

In our view, option 2 is the simplest and most direct means for small battery assets to access spot market value. An upcoming regulatory change will make it even easier to get set up in this framework, so if you’re not seeing good returns from your retailer-driven BESS operation and the WDRM looks too icky, it’s time to look at whether the SRA model might work for you.

In this post, we’ll recap how things work under the current arrangements and what changes you’ll see in the SRA framework when the Unlocking CER benefits through flexible trading rule commences in November 2026. In this post we’ll focus on the arrangements as they relate to <5MW batteries co-located with C&I customer load.

Two important things

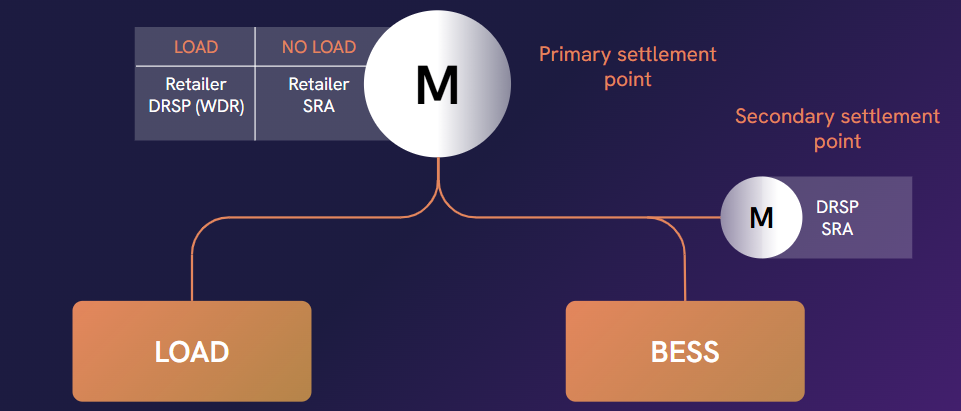

Everyone loves a good diagram.

There are two key things to know about batteries in the SRA framework before we get started:

The battery must have its own connection point and own meter, separate to any other load or battery/generating unit on site.

All imports and exports from the battery are settled at that connection point at prevailing spot price. This means you get direct access to the spot price with all its highs and lows - brilliant if you’ve engaged a smart operator, but potentially catastrophic if you have an idiot running the show (let’s face it, we all know at least one idiot that’s tried to run a show).

Note, AEMO requires each small bidirectional unit (i.e. each battery) to have its own child connection point and consequently its own child meter - that is, you can’t aggregate a bunch of batteries behind a single child connection point. It’s worth seeking legal advice on this one before you launch into an SRA setup.

How do things work today?

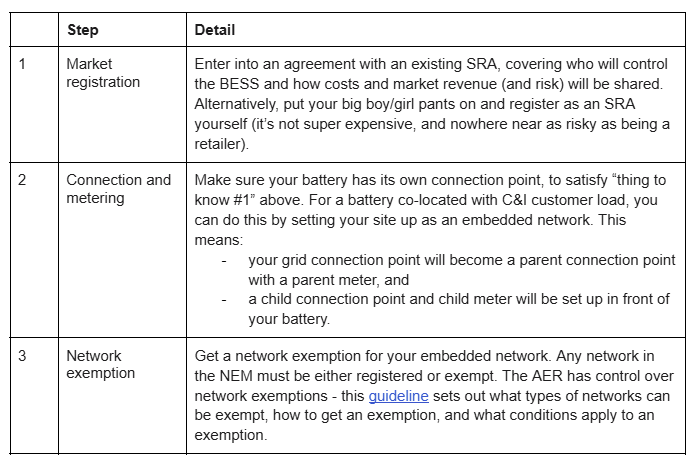

Here are the three main steps you need to go through to set up a battery in the SRA framework today.

This is the guideline referenced in the table - https://www.aer.gov.au/industry/registers/resources/guidelines/network-exemptions-guideline.

The SRA (f.k.a. SGA, where G stood for G-Unit Generation) framework has been used for over 10 years now, initially as a way for C&I customers with backup generators to earn spot revenue by running them and taking load off the grid when spot prices were high. Now, it provides a relatively simple way for battery owners and operators to unlock the biggest piece of the battery revenue puzzle - wholesale market access.

Importantly, this can be done independently of the retailer. The retailer remains the financially responsible market participant (FRMP) at the parent connection point, with the retail contract covering the supply of energy at that point. The SRA becomes the FRMP at the child connection point, with the SRA contract dealing with imports and exports at that point.

But it’s not all rainbows and butterflies.

10/10 if you get this reference.

What’s the problem?

The requirement to set up an embedded network and get a network exemption is fiddly, and arguably doesn’t deliver anything of value to the AER, AEMO, the SRA or the customer. The dense regulatory framework for embedded networks was not designed for SRAs - its real purpose is to ensure appropriate consumer protections for residential and small business customers in true embedded networks (like shopping centres and caravan parks). It’s overkill for a C&I customer on its own site doing wholesale market arbitrage with a battery.

The AEMC and the AER recognised this and sought to streamline things through a rule change.

The Unlocking CER benefits through flexible trading rule change

The main premise of the rule change request was to allow customers to engage more than one FRMP at a single premises. The idea was that this would drive innovation and competition by enabling customers to contract their flexible and non-flexible assets separately. That is, the customer could choose to have their crusty old retailer supply their boring non-flexible assets like lights and powerpoints, and then engage a cool new 3rd party to optimise the operation of flexible assets like batteries and EVs in the energy and FCAS markets.

But the SRA framework described above shows that large customers (i.e. C&I loads) can already engage two FRMPs at a premises by turning their site into an embedded network - a retailer at the parent connection point and an SRA at the child connection point. So, the focus of the rule change was originally on small customers (i.e. residential and small business), but it did look at ways to improve things on the large customer end.

Key components of the rule

Here’s a summary of the key components of the rule relevant to SRA battery sites.

Bye bye parent, bye bye child

These guys were great tbh

The rule no longer forces a parent-child embedded network arrangement on SRA sites. Instead, it enables large customers (i.e. C&I loads) to establish secondary settlement points behind their grid connection point and assign flexible resources there to a separate FRMP, e.g. an SRA.

Customers will be able to set up any number of secondary settlement points on their site. Each secondary settlement point will have its own meter and NMI (national metering identifier), meaning they can be separately settled in the NEM.

New rules, new roles

If we close enough deals this year, I’ll post a video of myself doing Dua Lipa songs in the style of Alan Partridge.

The rule creates a new role - the NMI service provider. This accredited party will be responsible for establishing and maintaining NMIs at secondary settlement points.

It will be the FRMP’s (e.g. SRA’s) responsibility to appoint a NMI service provider and make sure there is always one at a secondary settlement point.

Metering arrangements

The metering requirements are unchanged for large customers. Secondary settlement points must have a type 1, 2, 3 or 4 metering installation.

Large customers are also permitted to have a type 8A metering installation at secondary settlement point. This is a new type of metering installation, created in recognition that certain assets (e.g. EV chargers) have inbuilt metering capability.

For FCAS provision, metering requirements will remain as per the relevant service in AEMO’s market ancillary services specification.

Settlement arrangements

The rule delivers subtractive settlement between the primary connection point and any secondary connection points. Effectively, energy flows at the secondary settlement point are subtracted out from the primary connection point to prevent double-counting and enable accurate settlement. This is a formalisation of current practice in the SRA embedded network setup.

Network charges will continue to be levied on the FRMP at the primary connection point. No network charges for the secondary settlement point.

Got that?

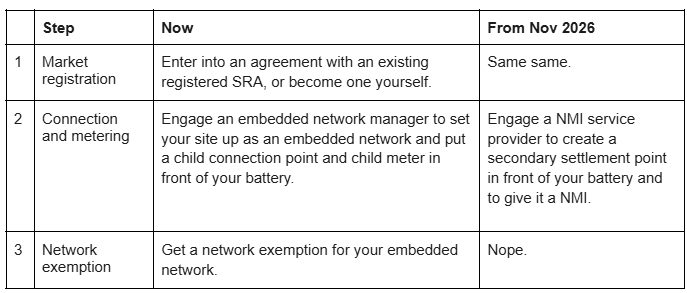

How this compares to now

Here’s a comparison of the process under the new rule against current arrangements. In short, the rule means you won’t need to establish an embedded network, get an AER network exemption, or be subject to the network exemption conditions.

Less bureaucracy, hooray!

Implementation and transitional arrangements

The rule change will commence on 1 November 2026.

AEMO has created and updated various procedures in preparation for rule commencement, including a new service level procedure for NMI service providers and updated MSATS and metrology procedures.

The introduction of the rule has the following impact on existing and new SRA sites:

existing embedded networks will remain embedded networks

large customers and FRMPs using embedded networks may choose, but will not need, to switch to the new framework

new entrants are encouraged, but not required, to use the flexible trading framework with secondary settlement points rather than establishing an embedded network.

So, there is no regulatory risk for sites set up before 1 Nov 2026, and any sites set up after will benefit from a more streamlined market entry process.

What does this mean for me?

The current SRA rules already enable C&I batteries to access the benefits of wholesale market arbitrage, and the new rules maintain that. But in terms of process, the new rules certainly deliver something more pleasant. Less admin, fewer irrelevant regulations with which to comply, what’s not to like?

Of course, if you continue to struggle to make the case stack up for your batteries, you could just apply for a regulatory sandboxing trial waiver.